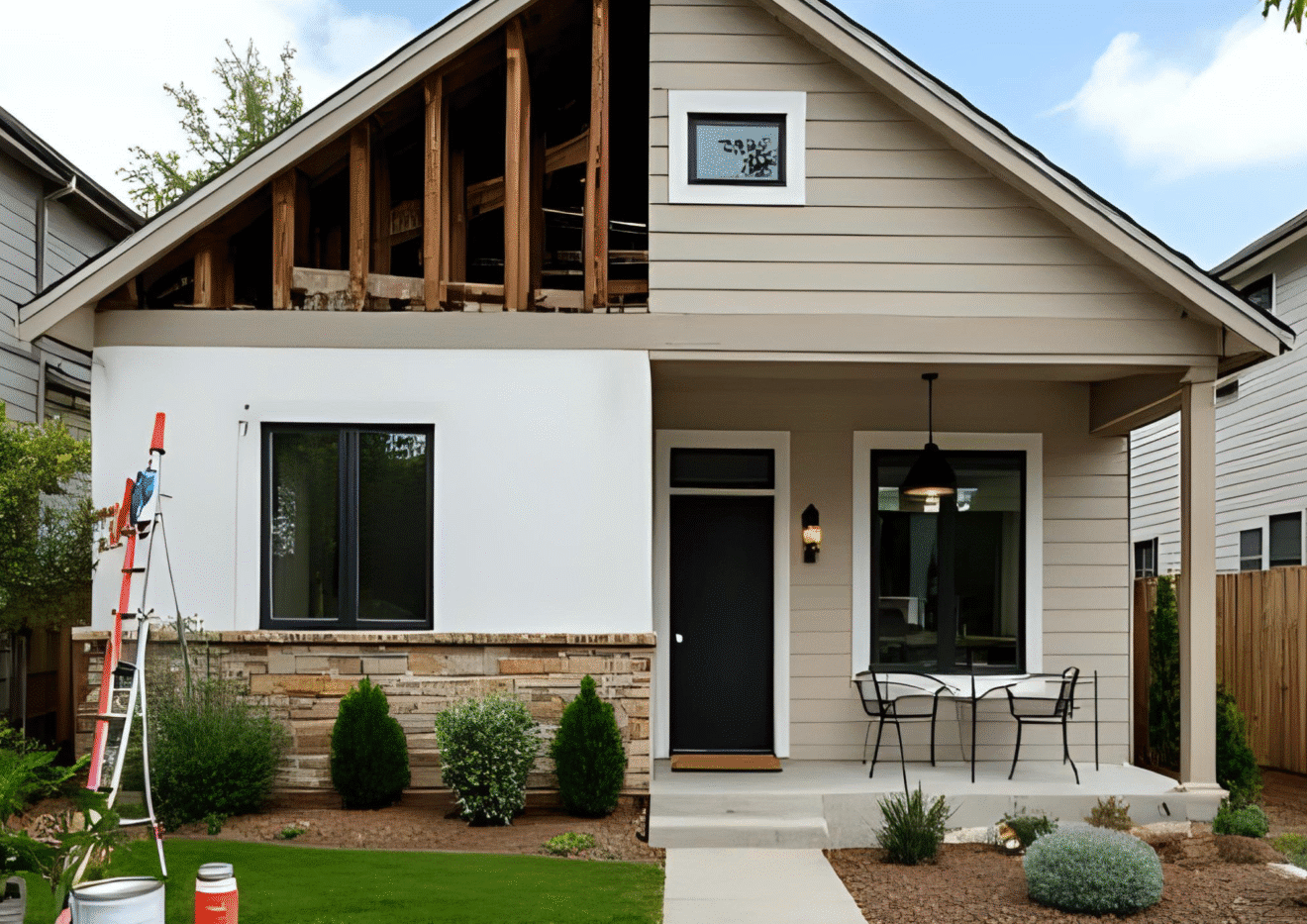

Buying a fixer-upper in the GTA is a bold move. It’s not just about finding a place to live—it’s about discovering the potential hidden beneath outdated finishes and long-forgotten charm. Many fixer upper homes in the GTA are old houses with unique character and renovation potential. Many homeowners are skipping over the glossy, move-in ready homes in favor of something a little more… lived in. Why? Because with the right updates, a fixer-upper can become a dream home and a profitable investment all at once.

When considering buying a fixer upper, it’s important to decide whether to renovate an old house or purchase a move-in ready home. This choice depends on your budget, lifestyle, and willingness to tackle the challenges of renovation head-on.

Buyers must also decide if they have the ability and resources to renovate a fixer upper home.

Introduction to Fixer Uppers

Buying a fixer upper can be one of the most exciting steps in your home buying journey, especially in a competitive market like the Greater Toronto Area. A fixer upper is a house that needs renovation or repair—sometimes just a little, sometimes a lot. For many buyers, the appeal lies in the chance to transform a property into their dream home while potentially increasing its market value. In a housing market where move-in ready homes often come with a premium price tag, buying a fixer upper can be a cost-effective way to get your foot in the door.

Of course, a fixer upper isn’t just about saving money on the purchase price. It’s about investment—both financial and personal. With the right vision and a realistic budget, extensive renovations can turn a dated property into a profitable investment. But it’s important to be prepared for the realities: renovation costs can add up quickly, and unexpected issues are almost guaranteed to pop up along the way. Whether you’re looking to build equity, customize your space, or simply find a way into the GTA market, buying a fixer upper is a decision that requires careful planning, a clear understanding of costs, and a willingness to tackle the challenges of renovation head-on.

Why Consider a Fixer-Upper?

The appeal is simple: cost and opportunity. Fixer-uppers often come with a lower purchase price, giving buyers a chance to enter the market at a more affordable level. Buyers benefit from the lower price paid for a fixer upper home compared to move-in ready homes, making it possible to control their budget and allocate funds toward renovations. For those priced out of move-in ready homes, a renovation project can offer a more manageable path to homeownership.

Types of Properties: What Kind of Fixer-Upper Fits You?

When exploring fixer uppers, it’s important to recognize that not all properties are created equal. Some fixer upper houses may only need cosmetic improvements—think fresh paint, updated fixtures, or refinished floors—while others require major repairs like a new roof, updated electrical, or a complete overhaul of outdated systems. The type of fixer upper you choose should align with your budget, your skills, and your appetite for renovation.

A move in ready home offers convenience and immediate comfort, but usually comes with a higher purchase price. On the other hand, a fixer upper property with a lower purchase price can be appealing for buyers looking to save money or build equity through home improvements. However, it’s crucial to factor in all renovation costs, including materials, labor, permits, and the potential for unexpected repairs. The location, size, and overall condition of the house will also impact your renovation budget and the amount of work required.

Deciding between a property that needs only minor updates and one that demands extensive renovations comes down to your financial considerations, your willingness to live in a construction zone, and your long-term goals. Are you hoping to create your ideal home from the ground up, or are you looking for a project that will allow you to make a few improvements and move in quickly? By understanding the different types of fixer uppers and what each entails, you can make a more informed decision and choose a property that fits your vision, your budget, and your lifestyle.

Lower Purchase Price Doesn’t Mean Lower Value

Just because you’re paying less upfront doesn’t mean the home isn’t valuable. In fact, the real estate market often rewards those who can see potential. A fixer-upper house in the right neighborhood may have more long-term value than a polished home in a declining area.

The Financial Considerations: Be Honest With Your Budget

Renovations cost money. Sometimes, a lot of it. When planning your renovation budget, consider financing options such as home equity lines of credit to help manage costs. Before buying a fixer-upper, buyers need to understand their full financial situation. That includes mortgage payments, renovation costs, and the inevitable unexpected issues that arise mid-project, which can increase the total money spent on the home.

What Renovations Actually Add Value?

Some renovations increase market value more than others. A renovated home with updated features can significantly increase its resale value. Updated kitchens and bathrooms are always a win. Replacing old electrical wiring or upgrading the HVAC system? Also smart. But some improvements—like refinishing floors or painting—are cosmetic. Necessary, but not always dollar-for-dollar investments.

Renovation Costs: Planning vs. Reality

A renovation budget isn’t a wish list—it’s a roadmap. Make a list of all necessary repairs and cosmetic upgrades. Then add 20% for the unexpected. Unexpected issues arise during renovations, often requiring more material and increasing costs, so budgeting for these surprises helps prevent delays and ensures project quality. Trust us, it always comes.

Move-In Ready vs. The Construction Zone

Living in a home while it’s under renovation isn’t for everyone. Expect dust, noise, and limited access to rooms. Renovations can take a considerable time to complete, requiring patience and flexibility from homeowners. If your family needs a move-in ready home, a fixer-upper may not be the right choice—at least not without temporary housing.

The Home Inspection Is Non-Negotiable

A thorough home inspection is essential. It helps identify major issues like structural problems, plumbing leaks, or outdated systems. Skipping this step could mean inheriting a house of problems instead of a path to wealth.

Renovation Loans and Financing Options

A renovation loan, like a Purchase Plus Improvements mortgage, can help cover the cost of upgrades right from the start. It’s a tool many buyers overlook—but it can be the difference between affordable and unmanageable.

DIY or Hire a Pro?

DIY projects can save money but can also lead to costly mistakes. Know your limits. Tiling a backsplash might be manageable. Electrical work? Probably best left to licensed professionals.

Time Investment: Do You Have It?

Renovations take time. Weeks can stretch into months. Make sure your lifestyle, job, and family situation can accommodate delays, mess, and decisions on everything from drywall to doorknobs.

How Much Can You Expect to Spend?

In the GTA, cosmetic improvements like paint, floors, and fixtures can run $20,000–$40,000. Larger renovations—kitchens, bathrooms, roofs—can easily exceed $100,000. The more extensive the updates, the more money and time you’ll need.

The Risks of Underestimating Repair Costs

Many homeowners underestimate how much repairs actually cost. What seems like “a little patching” can become a full roof replacement. Or a small leak reveals mold behind the walls. Be conservative when calculating repair costs.

Build Equity Through Smart Improvements

Well-planned improvements—especially in high-demand neighborhoods—can significantly increase a home’s resale value. That’s where the profit lies. You’re not just fixing—you’re building equity.

Know the GTA Market Conditions

The GTA real estate market is dynamic. Knowing the average cost of similar homes in your area can help guide your renovation investment. You don’t want to over-improve for the neighborhood.

Assessing a Property’s Investment Potential

Look at the home’s bones, not just its outdated wallpaper. A fixer-upper with a solid foundation, good location, and the right price can become a goldmine.

Understand the Resale Value

Resale value isn’t just about the final selling price. It’s about how much money you’ve put into the property compared to what you’ll get back. Smart renovations focus on return on investment (ROI).

Selling After Renovations: When Timing Matters

If you’re flipping the home or selling soon after renovations, timing matters. List in the spring or early summer for the most market activity and buyer interest.

Be Aware of Market Trends

GTA market trends can impact the success of your fixer-upper project. If interest rates rise or demand dips, even the most beautiful remodel may sit longer than expected. Always be aware of market shifts.

The Emotional Side of Renovating

Renovating is hard work. There are days you’ll wonder why you didn’t just buy a move-in ready home. But there’s also joy in transforming a space—and pride in knowing you made it yours.

Know When to Walk Away

Not every fixer-upper is worth the effort. If a home inspection reveals major issues—foundation cracks, asbestos, or extensive water damage—it may be best to walk away.

Think Beyond the Numbers

Buying a fixer upper is more than a financial decision. It’s a lifestyle choice. Consider your personality, time, stress tolerance, and desire to create a home from scratch.

Talk to a Real Estate Professional

Working with a real estate agent who knows fixer-uppers and renovation projects in the GTA is crucial. They can guide you through buying, budgeting, and even connect you with contractors.

Ideal Buyer Profiles for Fixer-Uppers

Not everyone is cut out for this path. Fixer-uppers make sense for handy individuals, buyers with renovation budgets, and people with a long-term outlook. If you’re after instant perfection, this may not be your road.

Evaluate the Neighborhood’s Potential

Even the best renovations won’t overcome a declining location. Look at local schools, amenities, safety, and overall market appreciation before deciding to buy.

When Cosmetic Upgrades Are Enough

Some homes don’t need major work—just a little TLC. A fresh coat of paint, new light fixtures, or updated cabinet hardware can make a big difference without major investment.

How to Prioritize Repairs and Upgrades

Start with what’s necessary—roof, HVAC, electrical. Then move to aesthetic upgrades. Don’t overspend on features the market won’t pay for.

Think Long Term, Not Just Flip Potential

Even if you’re not planning to sell right away, make choices that will hold value over time. A well-done renovation can serve your needs now and appeal to buyers down the line.

Avoid Over-Personalizing

When choosing finishes and layouts, aim for broad appeal. Neon green cabinets might be your style—but buyers might not agree.

Don’t Forget Permits

Renovations often require permits. Skipping them can lead to fines or problems when selling. Always check with your municipality.

Your Fixer-Upper Could Be Your Forever Home

Not every fixer-upper is a flip. For many homeowners, it becomes the place they raise kids, host birthdays, and build a life. If the bones are good and the vision is clear, a fixer-upper can be worth every cent.

Related Blogs You Might Like:

- The Best Schools in the GTA: A Homebuyer’s Guide

- What to Expect During the Home Selling Process in the GTA

- How to Create a Lasting First Impression When Selling Your GTA Home

Final Thoughts

Buying a fixer-upper in the GTA and calculating renovation costs vs. resale value requires clarity, patience, and a willingness to roll up your sleeves. But with smart planning and a clear budget, a fixer-upper can be the path to your dream home—or a profitable next move.

📞 416-498-3444

📧 jas@thebahiateam.com

🌐 www.bahiarealtygroupinc.com